My weekly read-around: from quasar astronomy to our forthcoming chaos-monkey-plus-sadistic-cruelty policy future, & much MOAR…

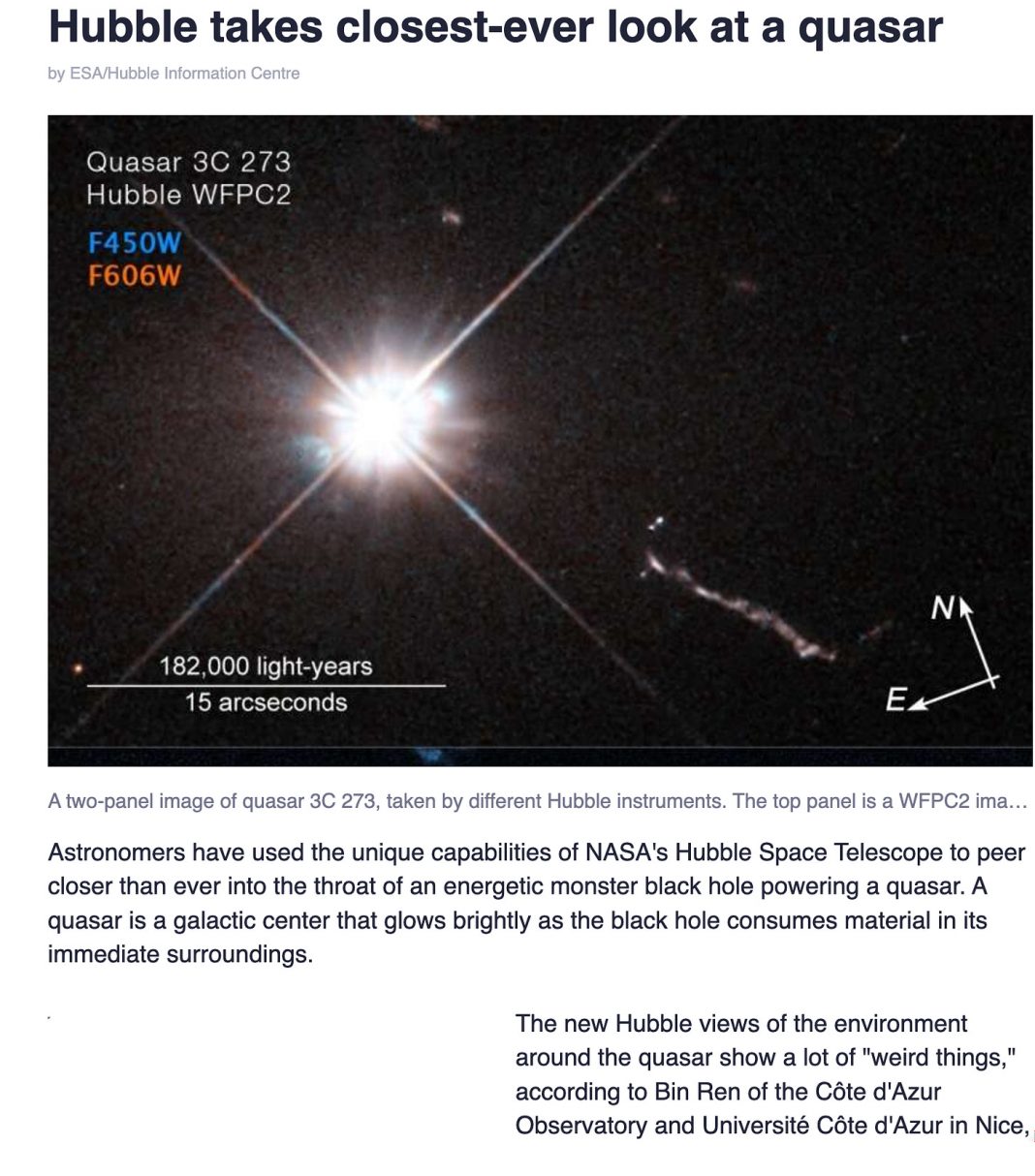

ONE IMAGE: Looking at the Unbelievably High-Energy Parts Of Our Universe:

ESA/Hubble Information Centre: Hubble takes closest-ever look at a quasar: ‘An energetic monster black hole powering a quasar… that glows brightly as the black hole consumes material in its immediate surroundings. The new Hubble views… show a lot of “weird things,” according to Bin Ren…. “We’ve got a few blobs of different sizes, and a mysterious L-shaped filamentary structure. This is all within 16,000 light-years of the black hole.” Some of the objects could be small satellite galaxies around the black hole, and so they could offer the materials that will accrete onto the central super massive black hole, powering the bright lighthouse…. The quasar… 3C 273… identified in 1963 by astronomer Maarten Schmidt as the first quasar…. At a distance of 2.5 billion light-years, it was too far away for a star. It must have been more energetic than ever imagined, with a luminosity over 10 times brighter than the brightest giant elliptical galaxies. This opened the door to an unexpected new puzzle in cosmology: What is powering this massive energy production? The likely culprit was material accreting onto a black hole…. At least 1 million quasars are scattered across the sky. They are useful background “spotlights” for a variety of astronomical observations. Quasars were most abundant about 3 billion years after the big bang, when galaxy collisions were more common… <https://phys.org/news/2024-12-hubble-closest-quasar.html>

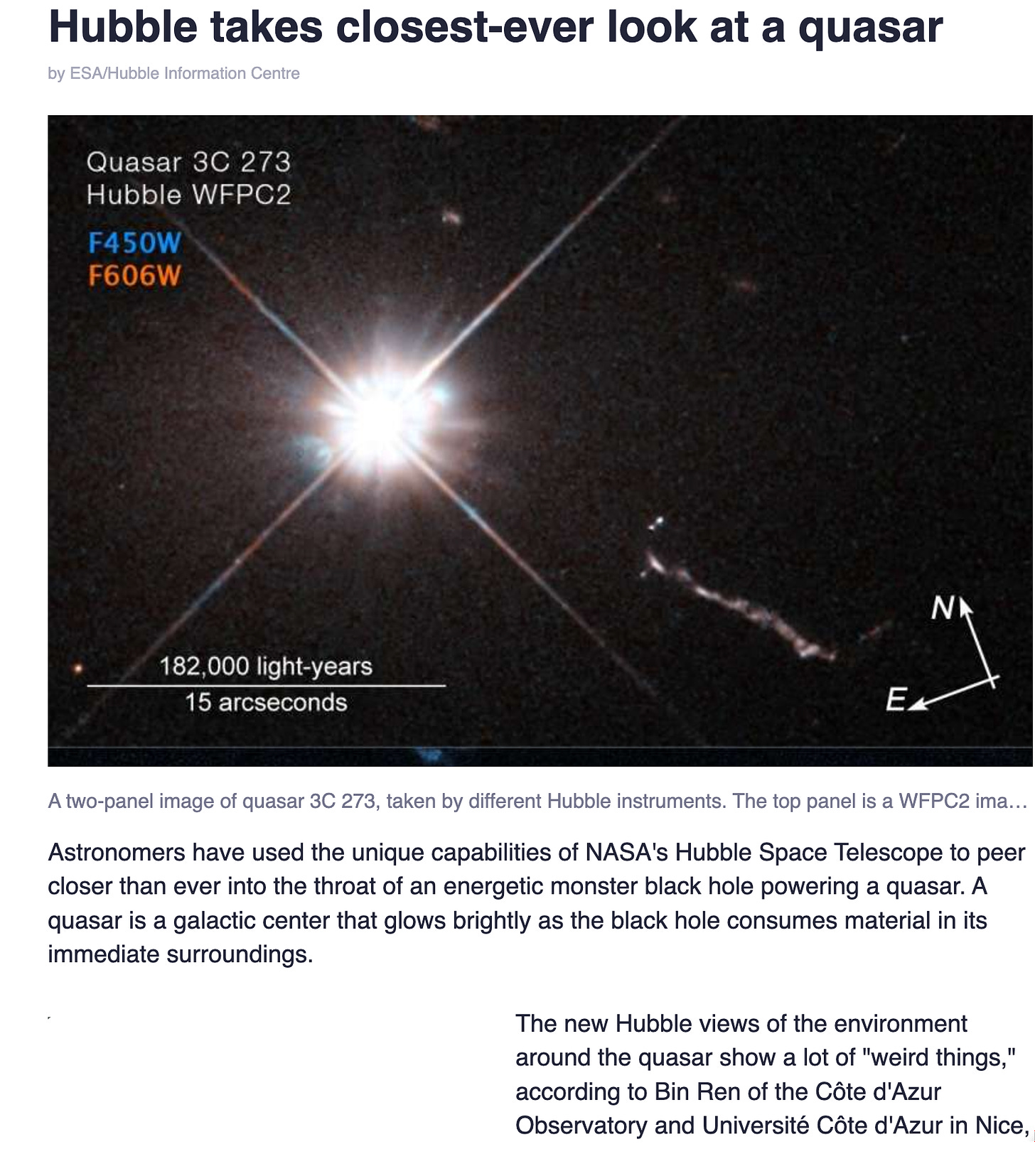

A SECOND IMAGE: No, WWIII Has Not Begun, No Matter What General McMaster May Say:

YET TWO MORE IMAGES: Where the Horse-Archers Come From:

I confess I have always been unhappy with this map above. There are lots of places that horse-lords—people who have been trained to ride and shoot since they were five—besides the labelled steppe belt from Hungary to Manchuria, plus central Anatolia. But this alternative map errs on the other side:

ONE VIDEO: Joe Biden on His Economic Legacy:

Outcomes: 16 million employment gain; lowest average unemployment rate in 50 years; strong GDP growth averaging 3% annually; record stock market highs. Policy achievements: American Rescue Plan, Infrastructure Law, CHIPS & Science Act, & Inflation Reduction Act. Challenges addressed: managing the economic aftermath of the COVID-19 plague; inflation has now decreased to near 2%.

In my view, policy has been good and Biden has been very lucky. I do not see any better outcomes within the possibility envelope—although probably an earlier Federal Reserve interest-rate liftoff would have been wise. In retrospect. I am still not sure whether it would have been wise ex ante…

ONE VIDEO: Olivier Blanchard on “Trumponomics”:

Olivier sees “Trumponomics” as consisting of tariffs, especially on imports from China; tax cuts on corporations, Social Security benefits, and tips; financial-sector deregulation, and mass deportations. I am not sure that is the way to bet—but it is hard to analyze policies that are essentially the random actions of chaos monkeys, with Rubio and Bessent trying to clean-up the monkey cage as it happens…

SubStack Posts:

If reading this gets you Value Above Replacement, then become a free subscriber to this newsletter. And forward it! And if your VAR from this newsletter is in the three digits or more each year, please become a paid subscriber! I am trying to make you readers—and myself—smarter. Please tell me if I succeed, or how I fail…

Very Briefly Noted:

-

Economics: I really do not think slow growth has to be a big feature of the current era in Europe. The U.S. has grown GDP per capita by 63% since 1991, compared to a big European three average of 37%. The U.S. has managed in spite of truly enormous headwinds. That means that there is a 20% growth gap the big European three really should be able to reap over the next two decades just to get back to where they were, relatively, in 1991:

Martin Wolf: ‘Is the post-2007 sluggishness the norm for the old high-income economies, except, perhaps, the US? Happily, some new opportunities do exist. One is to catch up on the US, as occurred in the 1950s and 1960s. For the UK, another opportunity is to raise the lagging incomes of the “left behind” regions. Another possibility is a return to the EU’s customs union and single market. But the UK might, instead, seek to be Donald Trump’s favourite country. For the EU, the opportunity is to implement the Draghi report in full. Yet what lies ahead for most of these economies, certainly including the UK, is… the burden of higher public spending… on defence and the aged… need[ed]… reforms… promoting competition, innovation and investment. In the UK… promot[ing]… savings… [and] encouraging immigration by skilled people. We must… hope… AI will raise productivity without destroying… information ecosystems…. Growth has to be sustainable, ecologically and politically. The growth slowdown is a big feature of our era. It has to be a focus for policy… <https://www.ft.com/content/78df4930-f012-4cbb-92a4-38df79a580e9> -

Economics: Chaos reduces the value of stock market indices. Falling stock market indices are bad news for the president, whoever the president is. Trump is terribly allergic to bad news. That suggests th at 2025 scenarios fall into two groups: (a) business as usual, in which Trump takes no steps that negatively impact the stock market—which means minimal tariffs and no mass deportation; (b) chaos, in which case the stock market loses confidence in Trump and he decides that it is his enemy—which means that investment in America may well collapse as everyone decides to wait and see how the chaos evolves before they commit to even maintaining their operations. The “small hit to the economy” seems to me to be an unlikely scenario—if it is your forecast, it is an expected loss-minimizing average expected value rather than a high-probability outcome:

Tom Orlik: Trump Agenda Won’t Hurt Global Economy as Much Next Year as in 2026: ‘Promised overhaul of conventional wisdom on trade, debt and security won’t happen overnight…. Donald Trump won a second term in the White House by promising a bonfire of the verities…. The blaze will take a while to get going, for the simple reason that any administration—even one with a working knowledge of Washington—can only move so quickly to implement its to-do list. For the year ahead, Bloomberg Economics forecasts global growth at an unremarkable 3.1%, unchanged from 2024. Inflation is set to slow to 3.4% from 6%, with readings in the US and other advanced economies drifting back to the 2% central banks have long targeted. Still, the global economy—along with the financial markets—is going to feel some heat…. Trump’s… tariffs are likely to stop short of his campaign-trail pledges… targeted, not across-the-board, and delivered in stages instead of all at once. For 2025 that means a modest impact on the US and China, building to a more significant hit to growth—spilling over to Mexico, Canada and other key trade partners—in 2026… <https://www.bloomberg.com/news/articles/2024-12-10/global-economy-won-t-feel-much-pain-from-trump-agenda-in-2025> -

Finance: The only way that active managers can beat the market as a collective is if they collectively take the opposite side of the non-passive trades and passive investors are forced to undertake—the price-insensitive forced trades as money flows into and out of passive, and as portfolio drift requires rebalancing. As a group active investors who do not do this are, collectively, burning money in their analyses and not winning:

Robin Wigglesworth: The ‘year of the stockpicker’ revisited: ‘You won’t believe how it turned out: How it started: Bank of America, January 4, 2024…. “If the rally continues to broaden, active funds will have greater odds of selecting winners in 2024. We expect more idiosyncratic opportunities next year given elevated valuation dispersion and increased public market inefficiencies, which should create a more supportive environment for stock pickers.” How it went: Bank of America, December 5, 2024…. “Only 23% of large cap active funds cleared their Russell benchmark, the worst monthly hit rate since March 2022. The average fund lagged by over 60bp…. Core and Value funds were the biggest laggards, with only 11% outperforming…. 35% of large cap funds are ahead of their Russell benchmark year-to-date (YTD), just below the annual average of 37% since 2003…” <https://www.ft.com/content/34b1d212-0577-4c24-80dc-18bb4980c6a0>

-

Economics & Tech: So what do the Board members who gave Gelsinger a four-year runway and then cut it short have to say for themselves these days?:

M.G. Siegler: Intel’s Destruction: ‘A few more details in digging into the backstory of what happened with Pat Gelsinger during his tenure as CEO of Intel. First and foremost, to a key point I made a couple days ago <https://spyglass.org/intel-outside-gelsinger/?ref=the-outer-ring-newsletter> around the board: Gelsinger was at first in discussions to join said board, before his vision for the future of Intel impressed them so much that they asked him to take over. And he agreed only after ensuring each board member was fully bought into his plan, which would take years and a lot of capital. In the end, they gave him three years, seemingly in part because he was spending too much capital. Beyond that, there’s a bit of history as to why he wasn’t set up for success and some bad luck (the Tower Semiconductor deal which China scuttled <https://www.wsj.com/business/deals/intel-scraps-tower-acquisition-after-china-fails-to-approve-deal-f59dd70f>– the incredible surge of NVIDIA <https://spyglass.org/ai-divine-nvidia/>). And he perhaps tried to burn an old, stagnant company a bit too hot with his “torrid” pace… <https://public.hey.com/p/LSNBAEvXm4QvTJLKnwmmBmeh> -

Bubbles: Is there something wrong with me that I see no way MicroStrategy can be a thing except as a highly leveraged bet on BitCoin at very unfavorable odds—that your returns are almost sure to be dominated in the long run by simply buying BitCoin rather than investing in MicroStrategy?:

Matt Levine: ‘We have talked about MicroStrategy a lot, and I have said that it is roughly in the business of (1) owning a big pot of Bitcoins, (2) selling stock at a large premium to the value of its pot of Bitcoins and (3) reinvesting the money in more Bitcoins. This is a weird enough business model. But to be fair MicroStrategy is also in the business of selling billions of dollars of convertible bonds to buy more Bitcoins, which is in many ways a much nicer trade: 1. Bitcoin is… volatile…. There is a lot of demand for options on Bitcoin…. MicroStrategy convertibles provide, in a very rough way, billions of dollars of Bitcoin volatility bets in a nice institutional-friendly package…. 2. MicroStrategy… also trades at a large premium to the value of its pot of Bitcoins…. There is no reason to think it is stable… so MicroStrategy can sell its volatility at a huge (and deserved) premium to the volatility of Bitcoin…. 3. Convertible bonds… are also a credit bet…. There’s one other really neat aspect…. Ordinarily… [there is] some limit on a company’s ability to sell convertibles: Convertibles are worth more if your stock is more volatile, but… convertible arbitrageurs will smooth out the moves in your stock…. MicroStrategy has, weirdly, found a solution: It sells volatility to convertible arbitrageurs, and buys volatility from retail ETF investors, so there’s always plenty of volatility to go around… <https://www.bloomberg.com/opinion/articles/2024-12-05/microstrategy-has-volatility-to-sell?> -

MAMLMs: I find myself envious of Dan Shipper and company. Taking one’s research materials and drafts and throwing a ChatBot at them as a way of getting more juice out of my writings—basically, an attempt at automatic superfootnotes and appendices accessed via voice interface—seems like a very attractive thing that is within our technological grasp right now:

Dan Shipper: Introducing Extendable Articles: ‘A new type of media that uses AI to expand your perspective…. A chat bot that lets you talk to the content that you’re reading. But there’s a twist: In an Extendable Article, we make available all of the source material—original interview recordings and transcripts, YouTube videos, news stories, articles, and more—that the writer used to put the piece together. So you don’t just get the writer’s perspective—you can chat with all of the information they used to inform it… <https://every.to/p/introducing-extendable-articles>

-

MAMLMs: Think: Clever Hans. Clever Hans watched you, and used your reactions to answer the question: Have I stomped my hoof enough times? But it did not know when that was—except by your reaction. “AI” watches you, and uses your (past) actions to answer the question: Is this the next word? And this the word after that? And it does so at frightening speed. But it is still Clever Hans in the form of autocomplete-on-steroids, interpolating an answer point in a high-dimensional vector space in response to a prompt that it not quite the prompts in its training set in order to make a function (prompts → answers) as you extend the domain of the training-data function to include the new prompt point. Now don’t get me wrong: this is heavy magic. For one thing, it has remarkable capabilities arising from Math in the context of high-dimensional vector spaces—such things as nearly all points on a high-dimensional sphere are very near the equator, and nearly all vectors in a high-dimensional space are nearly perpendicular to each other. As Cosma Shalizi says: “You Can Do That with Just Kernel Smoothing!?!…. You Can Do That with Just a Markov Model!?!!?!…” <http://bactra.org/notebooks/nn-attention-and-transformers.html>. But any time you have the center-of-gravity of Ethan Mollick here—that only somebody truly an expert who can recognize that the answer is wrong has any business using these tools—you really are in “Clever Hans” rather than “AGI” territory. (Not, mind you, that Clever Hans working at hypersonic speeds cannot be very useful as recognizing a right-enough answer is less of a cognitive load than coming up with one yourself. And putting to one side, mind you, the rather troubling whisper in the back of my mind wondering if we are not function-interpolating Clever Hanses rather than possessors of “AGI”.) But the idea that “AGI” can be accomplished by a blank-slate neural net with only 2 trillion parameters when our brains have 80 billion neurons x 100 states per neuron x 3000 dendrite-axon connections per neuron = 25 quadrillion parameters—10,000 times as many? And when our neural networks have been pre-trained to be much more than blank slates by 800 million years of evolution? Not remotely plausible:

Ethan Mollick: 15 Times to use AI, & 5 Not to: ‘Notes on the Practical Wisdom of AI Use…. Here are five subtle but important areas where AI use can be counterproductive: When you need to learn and synthesize new ideas or information. Asking for a summary is not the same as reading for yourself…. When very high accuracy is required…. When you do not understand the failure modes of AI…. When… by shortcutting that struggle… you… lose the ability to reach the vital “aha” moment…. When AI is bad…. Unfortunately, there is no general manual to tell you the shape of the Jagged Frontier of AI abilities, which are constantly evolving…. Knowing when to use AI turns out to be a form of wisdom, not just technical knowledge. Like most wisdom, it’s somewhat paradoxical: AI is often most useful where we’re already expert enough to spot its mistakes, yet least helpful in the deep work that made us experts in the first place. It works best for tasks we could do ourselves but shouldn’t waste time on, yet can actively harm our learning when we use it to skip necessary struggles. And perhaps most importantly, wisdom means knowing that these patterns will keep shifting as AI capabilities evolve… <https://www.oneusefulthing.org/p/15-times-to-use-ai-and-5-not-to> -

American Exceptionalism: Among the most prominent believers in American Exceptionalism and its importance was—Leon Trotsky:

Leon Trotsky (1930): My Life: ‘Here [on January 13, 1917] I was in New York, city of prose and fantasy, of capitalist automatism, its streets a triumph of cubism, its moral philosophy that of the dollar. New York impressed me tremendously because, more than any other city in the world, it is the fullest expression of our modern age…. We rented an apartment in a workers’ district, and furnished it on the instalment plan. That apartment, at eighteen dollars a month, was equipped with all sorts of conveniences that we Europeans were quite unused to: electric lights, gas cooking-range, bath, telephone, automatic service-elevator, and even a chute for the garbage. These things completely won the boys over to New York. For a time the telephone was their main interest; we had not had this mysterious instrument either in Vienna or Paris…. It would be a gross exaggeration to say that I learned much about New York. I plunged into the affairs of American Socialism too quickly, and I was straightway up to my neck in work for it. The Russian revolution came so soon that I only managed to catch the general life-rhythm of the monster known as New York. I was leaving for Europe, with the feeling of a man who has had only a peep into the foundry in which the fate of man is to be forged…<https://archive.org/details/in.ernet.dli.2015.175689>: Trotsky, Leon. 1930. My Life: An Attempt at an Autobiography. New York: Charles Scribner’s Sons. <https://archive.org/details/in.ernet.dli.2015.175689>. -

War & Rumors of War: I can hear Bill Clinton’s heart breaking in his voice as he reflects on how we got from the White House peace meeting of 1993 to our current trajectory, in which both Tel Aviv and Damascus—and in all likelihood other cities as well—will more likely than not burn with nuclear fire sometime in the next half-century:

Bill Clinton: ‘What has happened there in the last 25 years is one of the great tragedies of the 21st century…. Young people know… that a lot more Palestinians have been killed than Israelis. And I tell them what Arafat walked away from. And they can’t believe it…. He walked away from a Palestinian state, with a capital in East Jerusalem, 96% of the West Bank, 4% of Israel to make up for [what] the settlers occupied.… I go through all the stuff in the deal, and it is not on their radar screen. They cannot even imagine that that happened…. The first and most famous victim of the plans to give the Palestinians a state was Prime Minister Rabin… whom I loved as much as I have ever loved another man…. You walk away from these once-in-a-lifetime peace opportunities, and you cannot complain twenty-five years later… that the doors were not all still open and all the possibilities were not still there… <https://x.com/RpsAgainstTrump/status/1864786102248177952/> -

Sundowning in America: We have no idea whether Trump is (a) joking, or (b) serious—or thinking he is serious. And (c) if (a) and (b) are jokes, it is not clear what the jokes are supposed to be or why he thinks they are funny. Which strongly militates against the idea that they are jokes. And strongly militates for the idea that he is simply deluded and confused, and claiming he is joking is the only way his staff have found to try to get them and him out of the box:

Donald Trump: ‘It was a pleasure to have dinner the other night with Governor Justin Trudeau of the Great State of Canada. I look forward to seeing the Governor again soon so that we may continue our in depth talks on Tariffs and Trade, the results of which will be truly spectacular for all! DJT… <https://www.nbcnews.com/politics/donald-trump/trump-mocks-prime-minister-justin-trudeau-governor-great-state-canada-rcna183570>

Donald Trump: ‘The Democrats are fighting hard to get rid of the Popular Vote in future Elections. They want all future Presidential Elections to be based exclusively on the Electoral College!… <https://truthsocial.com/@realDonaldTrump/posts/113621278691359489>