As we head into the second half of the year, the swift recovery many were hoping for is facing an uncertain future. The resurgence of the COVID-19 virus and concerns about dwindling fiscal support have many worried. I submit that even in the absence of these worries, the recovery would still be on shaky grounds without the Fed explicitly committing to ‘make-up’ policy.

Make-up policy is an explicit framework that allows the Fed to correct for past misses in its target. In the case of a recession, this feature allows the FOMC to be fine with inflation temporarily overshooting its target while the economy bounces back. Tolerating this overshoot implies a similar surge in nominal income that would restore it to the levels expected by household and business prior to the crisis. This restoration is important since many fixed-price nominal financial obligations like mortgages, loans, and leases were made based on these forecasts of nominal income.

Without make-up policy, the Fed may feel uncomfortable with inflation temporarily overshooting and prematurely tighten monetary policy. This would prevent nominal income from returning to its pre-crisis trend levels and trigger secondary spillover effects like mass insolvencies and other financial stress.

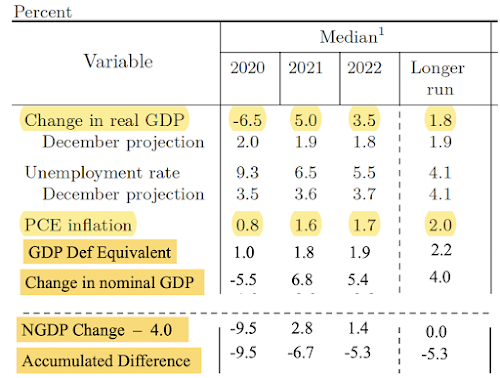

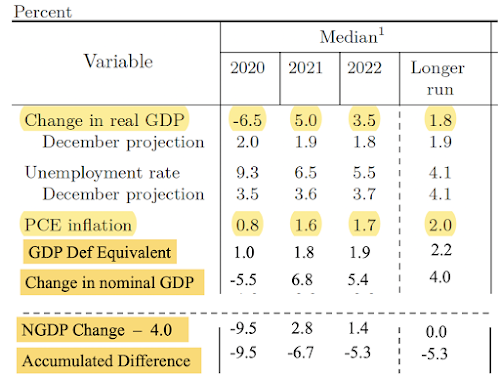

Nominal income or NGDP can be constructed from Table 1 in the SEP by combining the real GDP growth forecasts with the PCE inflation forecast plus 20 basis points (to make it GDP Deflator equivalent). This is done in a revised version of Table 1 below:

The second-to-the-last row of the table is titled “NGDP Change – 4.0” and is the forecasted NGDP growth rate minus the pre-crisis trend of 4 percent growth. The final row accumulates up these misses and reveals NGDP is still 5.3 percent below its per-crisis path even after 2022. Put differently, there is a permanent loss in nominal income according to the SEP.

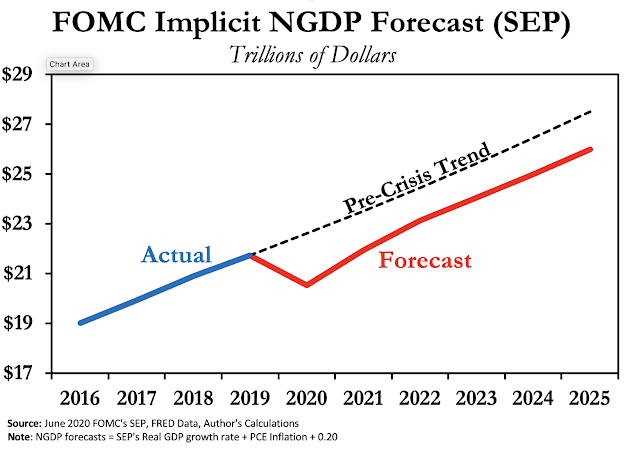

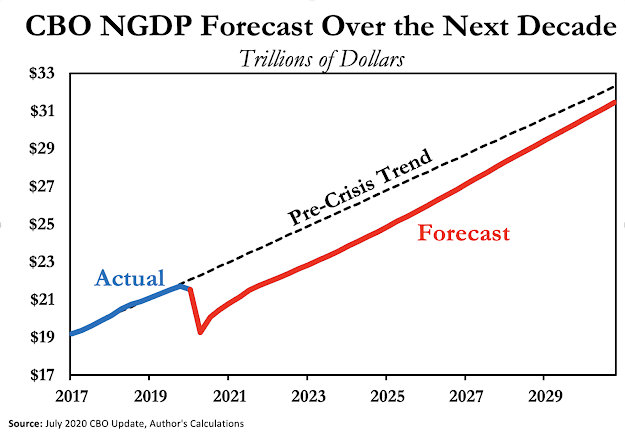

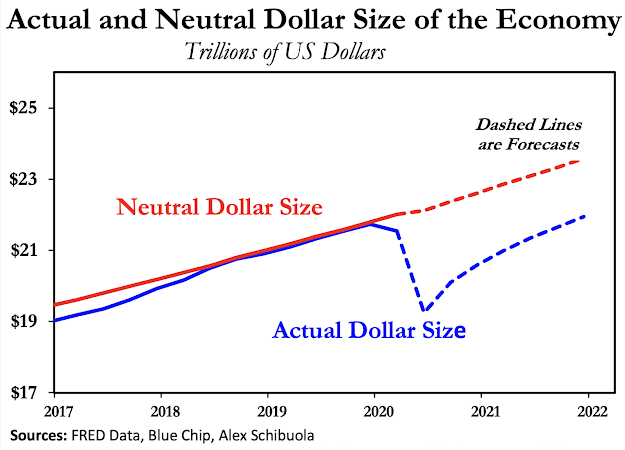

These forecasts are applied to the current NGDP levels to create a forecast in dollar level form and are presented in the figure below. The sustained drop in nominal income can be seen as the difference between the pre-crisis trend and the forecasted level of NGDP:

So wherever one looks, make-up policy is not being forecasted. Its absence does not bode well for the recovery and underscores the urgency of the FOMC review of its framework. I really dread repeating the slow recovery of the last decade. So please FOMC, bring this review to a vote and give make-up policy a chance during this crisis.

Update: A reader informed me that adding 20 bps to the PCE inflation to make it equivalent to GDP deflator inflation may overstate the difference. If so, the analysis above actually understates the permanent loss in nominal income projected by the FOMC’s SEP.