Today, we could say happy anniversary to France but it’s not a time to celebrate. Since 1974, for 50 consecutive years, she has had a fiscal deficit.

And, it’s time to get more concerned.

French Debt

With a deficit and debt that far exceed European Union caps, France is breaking basic budget rules.

At a projected 6.2% deficit to GDP ratio for 2024, France exceeds the EU’s 3% maximum. Correspondingly, close to 116%, France’s debt to GDP ratio far exceeds the EU’s 60% cap.

To understand why these ratios matter, we can think of home mortgages. If we decided to borrow $2 million for a house, most of us would say the amount is huge. However, if your wealth is $50 million, then it is a relatively small debt to repay. By contrast, someone with a net worth of $100,000 would consider $2 million a massive burden. Similarly, to decide if a nation’s loans are risky, we can compare the money they borrow to their GDP.

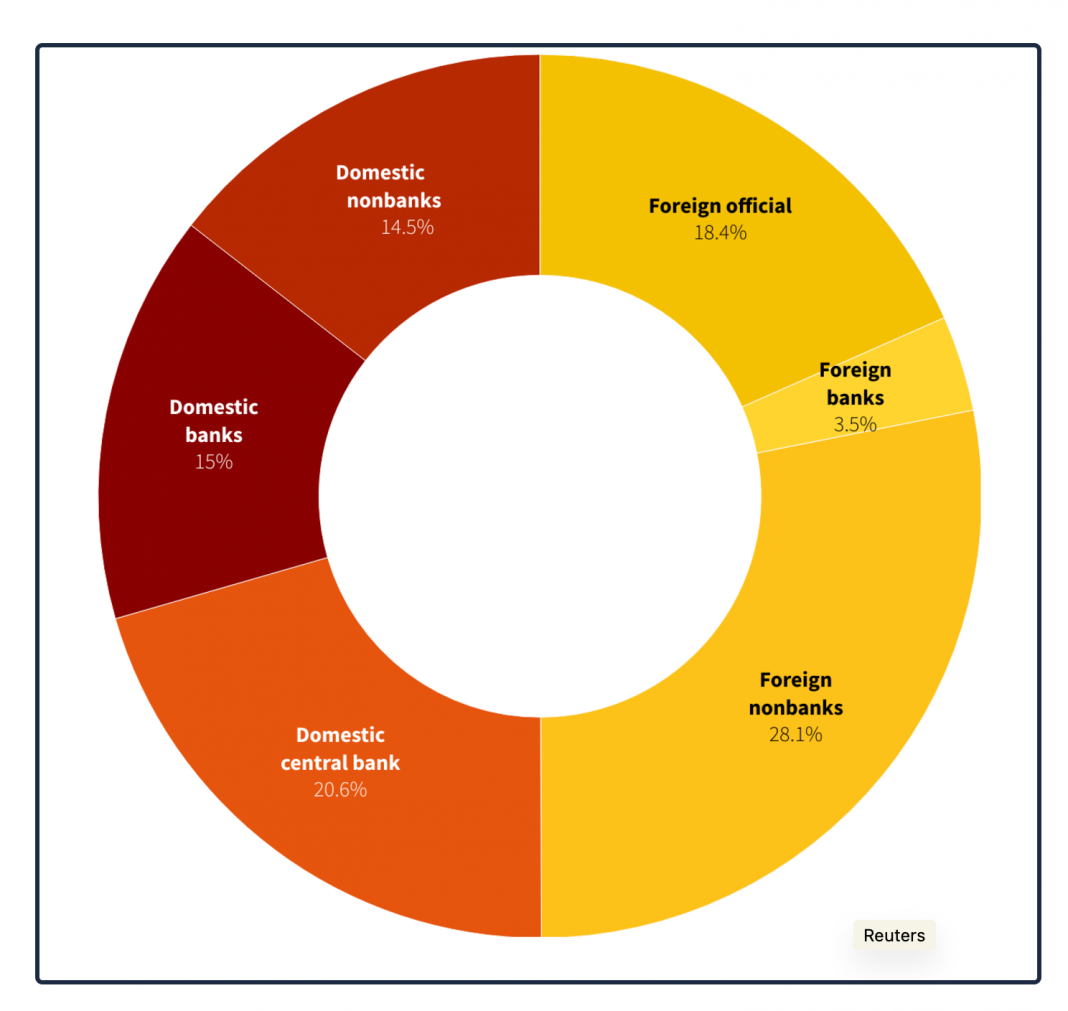

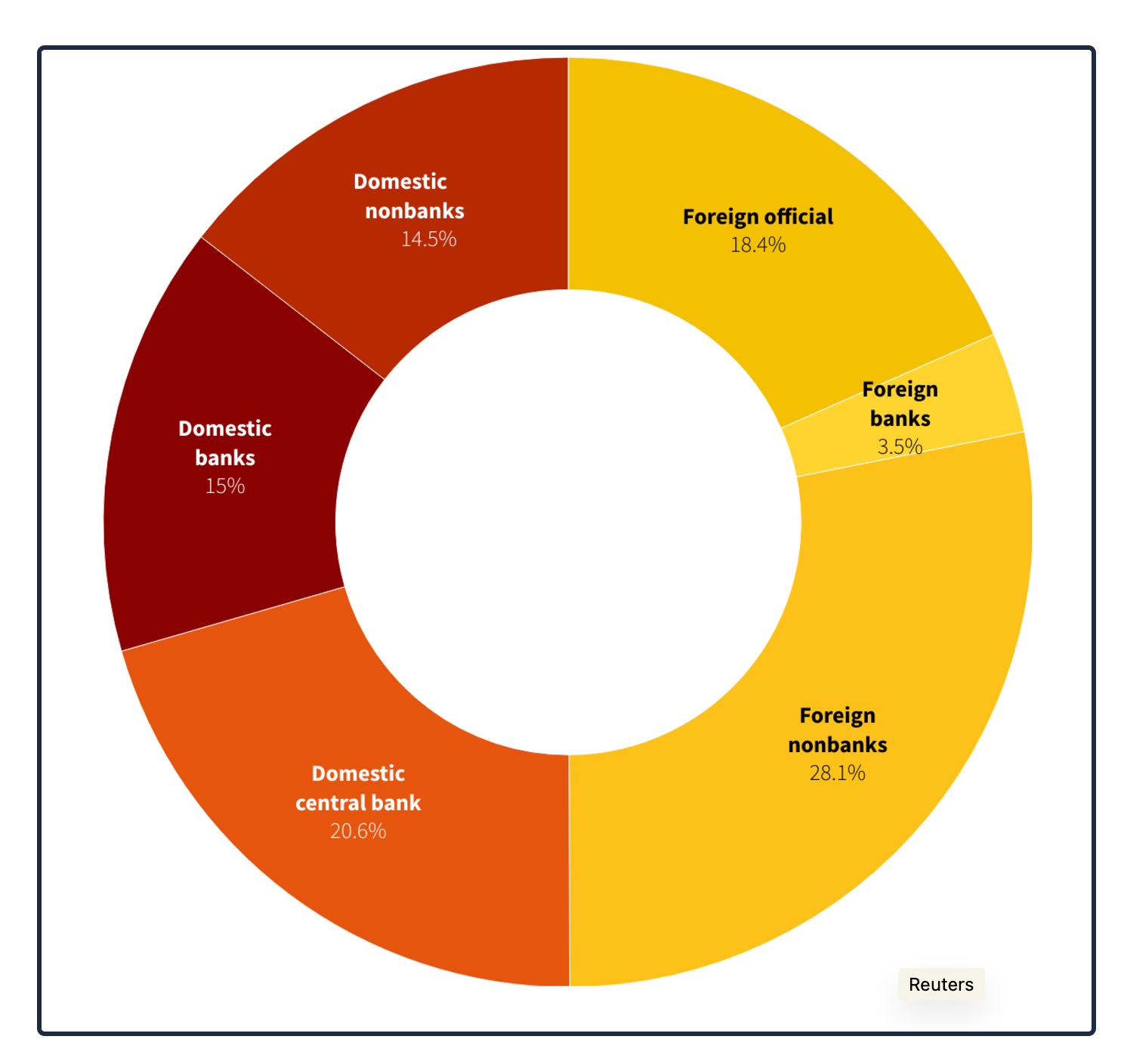

These are the entities that care if the French debt is risky. They include many non-French creditors:

Because France borrows money mostly by selling bonds to countries, businesses, and individuals, her creditors care about interest rates. Predictably, the more risky the loan, the higher the rate. However, rising interest rates are another reason for rising deficits.

In addition to interest payments, three words help to indicate why the gap is growing between France’s revenue and her spending:

- Lifespan: The average French lifespan is 82.5 years.

- Healthspan: In France women can expect 65.9 healthy years while for men, it’s 64.4 years.

- Workspan: The retirement age in France just increased from 62 to 64 years.

Yes, they all add up to higher healthcare costs.

Our Bottom Line: The Battle

Perhaps oversimplifying, we can say that it all adds up to a battle between politicans and interest rates. Politicians want to continue offering the high quality healthcare that France is known for. They also tried to avoid raising the retirement age to 64 last year. However, by spending more, they elevate the deficit, exacerbate risk, and nudge interest rates skyward.

Returning to today’s title, we can wonder if the story of French debt has a happy ending.

My sources and more: Thanks to the BBC’s World Business Report podcast for inspiring today’s post. From there, a Bruegel podcast and paper also had considerable detail as did Reuters. Then, as a foundation, this Greek debt econlife post and this (excellent) description of the French healthcare system came in handy.