China and Russia Face Mounting Pressures as US Economy Remains Resilient

Historical Parallels and Potential Consequences

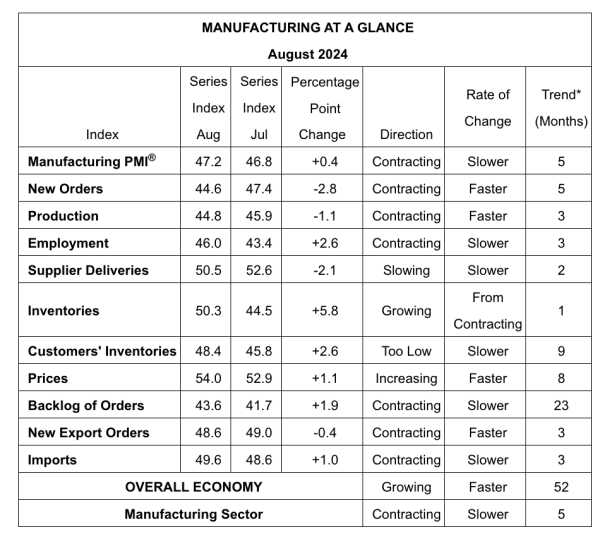

Yesterday we got the US ISM numbers, which surprised somewhat on the downside, which has caused recession fears in the US to rise again. The market is now again increasingly seeing a chance that the Federal Reserve will cut its key policy rate by 50bp in two weeks. Frankly speaking, I am also increasingly leaning in that direction, and if I had been a FOMC member, I would likely also have voted for a 50bp cut to avoid pushing the US economy into an actual recession.

Source: Institute of Supply Management

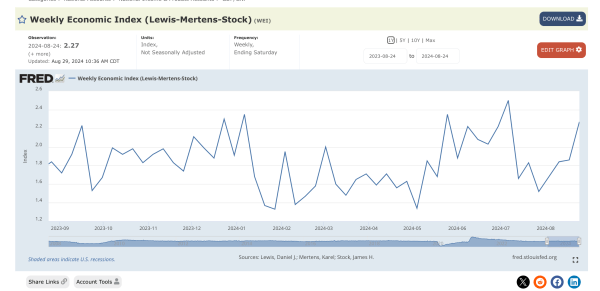

That being said, if I look at my favourite high-frequency indicator for the US economy – the Weekly Economic Indicator from the New York Fed that historically has tracked actual US real GDP growth very well – there are no signs of a slowdown in US growth.

So if US real GDP is actually growing around 2.25-2.50% right now, what is the problem then?

The Real Problem: China’s Deepening Crisis

I think the core issue really isn’t the US, but rather China. The crisis is clearly deepening in China, and that is what, for example, is visible in the recent decline in global oil prices.

So what is happening? In my view, this is mostly about China – and therefore about the global manufacturing sector.

In my view, the Chinese economy is in serious trouble and is facing very serious structural economic headwinds. The People’s Bank of China (or rather the Chinese Communist Party) should allow the Chinese Yuan to weaken – likely substantially – to avoid a debt-deflation crisis as I stressed in my recent post.

The CCP’s Reluctance and Its Consequences

However, as I also stressed in the post, the CCP is not willing to accept a major weakening of the yuan as this would make it blatantly clear to the Chinese public that China is in a much bigger and much more fundamental crisis than the Communist Party is willing to admit. Consequently, the yuan is being kept artificially strong, and this is very visible in money supply growth that is turning negative and is indicating that the Chinese economy is already in a recession and is likely to deepen.

Historical Parallels: The 1990s Asian Financial Crisis

Therefore, what is happening now in many ways is similar to the global economic situation in the second half of the 1990s.

At that time, the US economy underwent a major positive supply shock in the form of technological innovation (the internet) and significant immigration. Exactly as now.

This, however, was not to the same extent the case for the Asian economy that had seen an unsustainable boom starting to come to an end, and countries like South Korea could not ease monetary policy – even though it was needed due to the won’s peg to the dollar.

The Domino Effect of Currency Crises

And as the dollar kept strengthening, the Asian pegs increasingly came under pressure, and we all know how that ended – currency and banking crises spread across South East Asia as one country after another was forced to give up their pegs.

The problem, however, was not that countries floated their currencies – the problem was that they waited so long to do it and in the process caused a deflation-debt crisis. And as the crisis spread throughout Asia and to global Emerging Markets, oil prices plummeted.

During 1997, oil prices were cut in half, and the decline continued during 1998. This was a major contributing factor igniting the Russian debt and currency crisis that led to the collapse of the ruble and the Russian default in August 1998.

Present Day: China as the New Epicenter

This in many ways is exactly what we are seeing now. The dollar is strengthening – the Fed has been hiking rates and the “peggers” – at that time, for example, South Korea and Taiwan – got “squeezed”. This time around, it is China that is heading for a squeeze – and potentially a crash.

This obviously is negative for the global manufacturing sector, but as in the 1990s, the US economy keeps pushing ahead driven by technological progress and immigration.

Russia’s Vulnerable Position

And this time around, Russia is likely to get into very serious trouble if oil prices continue to drop as the China crisis deepens further.

Geopolitical Differences: Allies vs. Foes

The difference this time around is that in 1997, it was allies of the US – South Korea, the Philippines, Taiwan, and Thailand that got into trouble, and consequently, the US and the IMF flew in and saved the day (so to speak). This time around, it is a foe of the US that is in trouble, and there is no political will in the US to try to bail out China in any way. Other than, of course, China owns a lot of US government bonds.

And for Russia, it looks even worse. In 1998, the US and the West were eager to help Russia despite massive corruption problems and economic mismanagement. At that time, Russia was seen as a young democracy and a partner of the West. Now Russia is a foe and a totalitarian regime.

Implications for Global Economic Policy

So what does this mean? In my view, the Fed surely will react to any deepening of the Chinese crisis that has global ramifications, but policy will be focused on the impact on the US economy, and there will not be any US Treasury Secretary or Fed chairman jump in and help China – as Larry Summers and Alan Greenspan did in 1997 in South East Asia.

So yes, we will surely get US rate cuts, and 50bp is probably warranted already in two weeks, but there will not be any “global bailout”. And markets surely know this.

The Inevitable Outcome

Therefore, the exodus of capital from China in my view is likely to intensify going forward, and yes, eventually China will have to do what the South Koreans did in 1997 – accept a significant devaluation of its currency.

If you want to know more about my work on AI and data, then have a look at the website of PAICE — the AI and data consultancy I have co-founded.