Let’s assume that you save for retirement, or that a company is trying to raise a new factory. What is common here? Bonds could be involved. A bond is a fixed-income security. For issuers and investors alike, bonds become valuable. It’s that source of funds for issuers. For investors, it provides a potential return.

These instruments are strong: they allow borrowing and lending. Interest rates and investments are affected.

What Bonds Are – The Basics Explained

Let’s dig into what bonds really are. What makes them tick? Well, a bond is simply a debt instrument. An investor loans money. The borrower promises to pay it back. This includes interest.

There are core elements of a bond. The entity includes the principal, coupon rate, and maturity date. The principal is the face value: that’s what gets repaid at the end of the bond’s term. The coupon rate is the interest rate-it’s paid on what is called the principal. Four maturity-dates occur when the principal is paid back.

Example: Say you have a bond. The face value is $1,000, has a 5% coupon with a maturity of 10 years. The issuer pays $50 for a year. This amounts to 5% of $1,000. After the 10 years, $1,000 is repaid.

Government, Corporate, and Municipal Bonds

Government Bonds

Issuance of government bonds occurs for governments. Treasury bonds are in the U.S. Gilts also form part of these in the U.K. Generally, such bonds are perceived as safe. In short, a government backs the bond.

Corporate Bonds

Corporate bonds are from companies. It uses this to fund operations in a company. This is how they finance expansion.

Municipal Bonds

Municipal bonds (Munis) are given by state and local governments. They fund public works. Some of Munis have tax advantages.

Understanding Bond Ratings

Bonds ratings are crucial. Agencies such as Moody’s, S&P, and Fitch have rated bonds. They give an assessment of the reliability and risk of the bond default.

Investment-grade bonds have lower risk. High-yield bonds are riskier by nature; hence, potential reward increases with risk.

How Bonds are Functional to the Economy

These macroeconomic effects can be traced to the point of issuance and trading of bonds. Then, how is this all related to the bigger picture?

Bond Issuance and Interest Rates

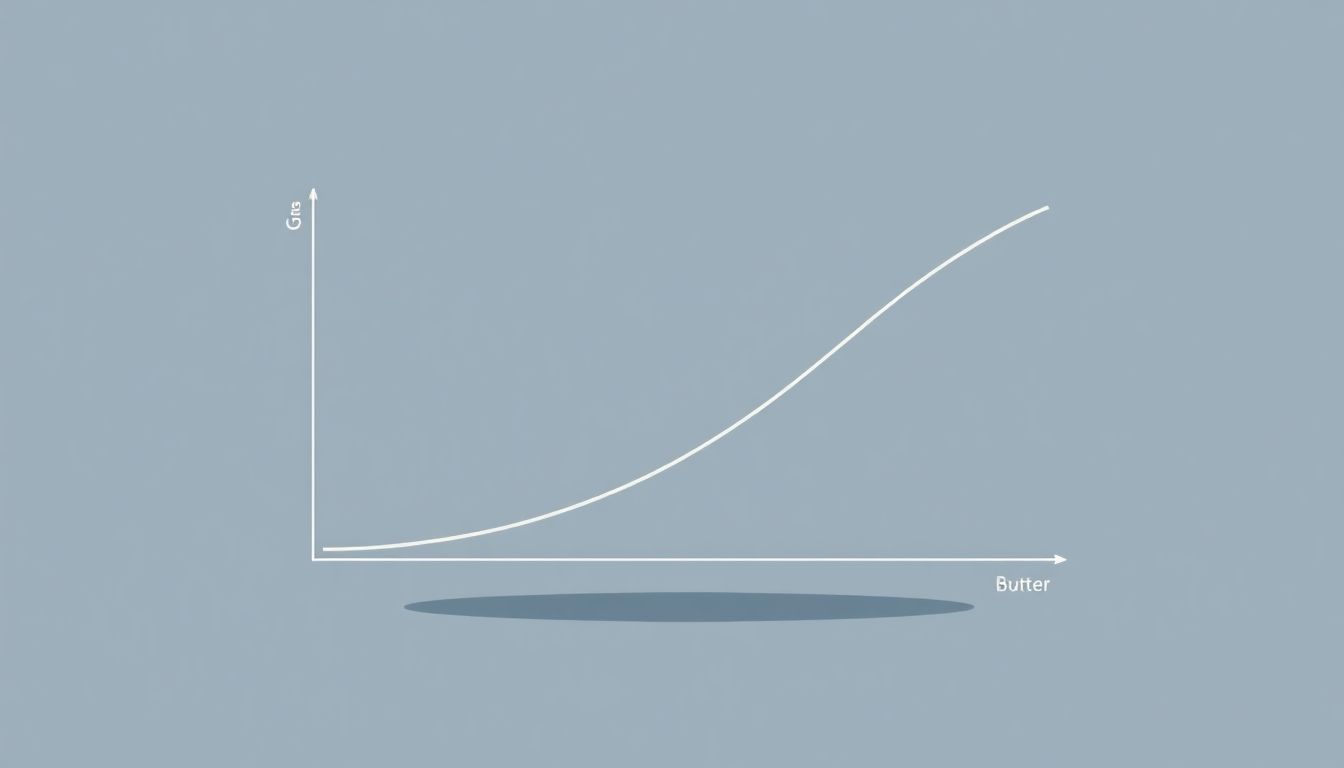

These two have an inverse relationship. Bond prices and interest rates move in an opposite direction. When interest rates rise, bond prices fall.

The interest can be given by bonds.

Bonds then form a source of capital for companies.

| Feature | Bond Financing | Equity Financing |

|---|---|---|

| Repayment | Must be repaid | No repayment required |

| Tax Treatment | Interest is tax deductible | Dividends are not deductible |

| Ownership | No ownership dilution | Dilutes ownership |

Example: Imagine Company X. It has issued bonds to finance its expansion. Ownership dilution doesn’t take place. Nonetheless, it adds the amount to the company’s liabilities.

Bonds and the Management of Government Debt

Governments issue bonds to service the debt. Indeed, these instruments help to finance deficits. Funding for projects occurs in this manner.

The yields on government bonds serve as a price barometer. They affect other interest rates. Such government instruments influence mortgage rates.

Investing in Bonds: A Primer for Beginners

Interested in investing in bonds? Here is a bit of a help. What do you need to think?

Risk and Return in a Bond: An Assessment

- Credit risk: What if the issuer defaulted?

- Interest rate risk: What if rates were to rise, thereby reducing the value of a bond?

- Inflation risk: Erodes returns

The yield to maturity (YTM) is an important indicator. It estimates the total return an investor can expect. It also involves coupon payments and repayment of the principal.

How to Build a Bond Portfolio

Diversification is important. Cast your net wide among bonds. Consider a range of maturity dates.

Think about your investment objectives. Risk tolerance? Tailor your bond portfolio accordingly.

Buying and Selling Bonds

There are a couple of ways to buy bonds from brokers and sell bonds online. In addition, with bond funds and bond exchange-traded funds (ETFs), you’ve got another angle to consider.

Know the bid-ask range. This is the difference between the price at which you are buying and the price at which you are selling.

Bonds-Peacekeepers for A Stable Economy

Bonds can act as safe havens, especially in times of economic stress. Let’s take a look.

Bonds as the Antidote for Inflation

Treasury Inflation-Protected Securities (TIPS) would help. TIPS insulate against inflation. The principal amount adjusts based on the Consumer Price Index (CPI).

Inflation is a death knell for fixed-rate bonds. But TIPS preserve the value of your investment.

Bonds in Recessional Periods

In a recession, it is a flight to safety. Investors rush to bonds. Interest rates usually fall.

With this, bonds would create monetary equilibrium. They offer a hedge against other depreciating assets.

Bonds and Central Bank Policy

Quantitive easing (QE) prominently affects bond markets. Central banks buy bonds, thereby reducing interest rates.

Central banks control monetary policy. They may manipulate the market using bonds to inject money into the economy.

The Outlook for Bonds

What lies ahead for the bond world? Let’s take a look at some trends and potential developments.

Impact of Increasing Rates

An increase in interest rates has a direct effect on the value of bonds. The old bond will be less desirable due to decreased yield. The new bond will yield higher.

Investors have an opportunity to invest in bonds with shorter maturities to lessen the impact.

Sustainable and Green Bonds

ESG investing is hot. Sustainable bonds and green bonds would fall into this umbrella.

Green bonds are issued by companies in order to fund environmentally responsible projects.

Conclusion

Once again, bonds are beneficial for all parties involved: issuers and investors. Through bonds, cash flows into public use, while investors are assured of steady returns. Knowing the basics of bonds is an ultimate survival tool. Bonds hold together the functioning of an economy. They can form a part of a diversified investment portfolio.