Stanley Fischer has passed away at the age of 81.

For those of us who have followed monetary policy closely over the years, this is not merely the loss of a prominent economist. It marks the departure of one of the rare practitioners who truly understood what it means to safeguard nominal stability – and who, as I have repeatedly argued on this blog, delivered on that promise in a way few others have managed.

A Life Shaped by Economics and Public Service

Born in 1943 in Mazabuka, Northern Rhodesia (now Zambia), Fischer’s upbringing was cosmopolitan and intellectually rich. His family, of Jewish-Latvian and Lithuanian descent, moved to Southern Rhodesia, where Fischer became active in the Zionist youth movement. This early global outlook would later inform much of his thinking as an economist.

He won a scholarship to the London School of Economics, completing both undergraduate and master’s degrees there before moving to MIT for his PhD, which he earned in 1969.

Fischer went on to an extraordinary academic career – first at the University of Chicago, and later at MIT, where he supervised and inspired a generation of central bankers, including Ben Bernanke and Mario Draghi.

His subsequent public service career is the stuff of legend: Chief Economist at the World Bank, First Deputy Managing Director at the IMF during the Asian crisis, Governor of the Bank of Israel (2005–2013), and Vice Chair of the Federal Reserve (2014–2017). Fischer became an American and Israeli citizen, and his influence reached across continents.

The Master of Nominal Stability – My Own Assessment

Readers of The Market Monetarist will know that I have long held Fischer in the highest regard.

In fact, I have often cited him as the central banker who came closest to running a true NGDP target in practice. His time at the Bank of Israel was nothing short of remarkable.

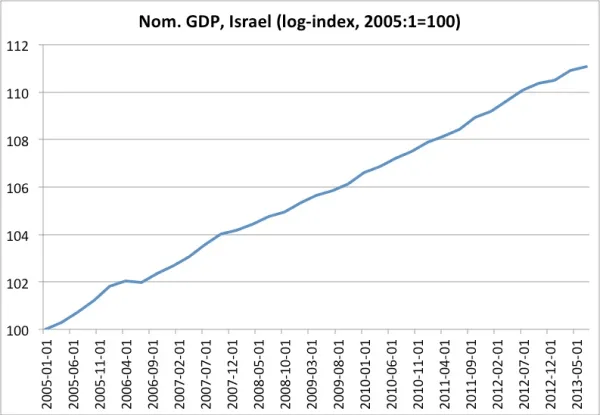

While central banks across the world floundered during the Great Recession that started in 2008, Fischer kept Israel’s nominal GDP on an astonishingly straight path – barely deviating from trend even at the height of global turmoil.

In a 2013 post (“Stanley Fischer – this guy can keep NGDP on a straight line”), I pointed out that Fischer’s stewardship resulted in an Israeli economy that largely escaped recession, thanks to his willingness to innovate and act decisively.

When the crisis hit, Fischer deployed quantitative easing and FX intervention long before it became fashionable in the advanced economies. The result: Israel’s real economy slowed, yes, but quickly returned to trend as soon as global conditions stabilised.

As I have argued elsewhere (“How Stan Fischer predicted the crisis and saved Israel from it”), Fischer’s intellectual flexibility – the ability to move beyond orthodoxy and focus on the centrality of nominal demand – proved decisive. He was, in my view, running the closest thing the world has seen to a pure NGDP targeting regime.

Not Without Critique – But Always With Respect

I have not always agreed with Fischer, especially in his later years at the Federal Reserve, where I felt his focus shifted too much towards concerns about bubbles and imbalances, and away from a simple focus on nominal stability (“Did Bill Gross get some insight from this blog? Maybe but it might (unfortunately) be outdated”).

Even so, his pragmatism, his humility, and his deep knowledge of both academic and practical economics always commanded respect.

A Lasting Legacy

We do not see many Stanley Fischers in monetary economics. He combined academic rigour with practical wisdom and genuine humility. His legacy endures not just in the institutions he served, but in the lives and careers of those he mentored, and in the intellectual clarity he brought to some of the world’s most difficult economic challenges.

Rest in peace, Stanley Fischer. Central banking, and those of us who care about nominal stability, owe you a debt of gratitude.

Selected blog posts on Stanley Fischer: