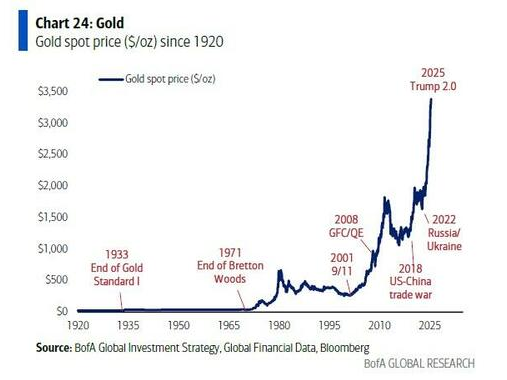

Today we see that a topic we look at from time to time and try to figure out is back in the high life again as Steve Winwood would say. Via Barchart on Twitter (X).

As you can see not only has there been quite a move recently the changes since the Bretton Woods announcement look quite extraordinary. If we start with the recent move this is where we stood when I took a look on the 31st of January.

Spot gold rose 1.2% to $2,793.25 an ounce by 11:50 a.m. ET, having hit a record $2,798.50 earlier in the session. US gold futures gained 1.9% to $2,846.20 per ounce.

Whereas today we see this.

On the international stage, gold prices soared on Friday as investors flocked to safe-haven assets in light of Israeli airstrikes on Iran, which rekindled fears of a broader Middle Eastern conflict, according to Reuters. Spot gold climbed 1.3% to $3,428.10 an ounce, drawing tantalizingly close to its record high of $3,500.05 from April. For the week, gold prices surged nearly 4%. ( Retail News Asia)

Some of this is a safe haven move at a time of war in the Middle East but the truth is that as you can see from the chart above is that Gold Bugs have been having quite a party. Some of this is an asset revaluation and some of it is inflation and as I have pointed out many times before it is not so easy to break it down as the moves sometimes counter logic.

The Big Read

The Financial Times has been hand in glove with the central bankers over the years and like them has had an absolute disaster.

John Maynard Keynes once called it a “barbarous relic”, an ancient metal with little relevance in the modern world. When the gold-backed global monetary architecture came to an end in the early 1970s, central banks started selling their holdings — and they continued doing so for decades.

This has echoes of the recent QE period where central bankers bought bonds at the top and are presently selling at the bottom.This time they started by selling at what we can see from Barchart was not only the bottom but an even worse sale than for QE.

It somehow slips the mind of the journalists to point out that this was also a view frequently to be found in the pages of the Financial Times.

For the guardians of the global economy, gold — which has been used as a store of value since the first gold bars were created in Mesopotamia thousands of years ago — seemed destined for irrelevance.

Indeed here is Alan Beattie of the Financial Times from May 2011. The emphasis is mine.

The continued run of the gold price is a global investment sensation. Recently it broke the $1,500 an ounce barrier for the first time, 30 per cent higher than a year ago. Surely this lays bare the extraordinary foolishness of Gordon Brown’s announcement, 12 years ago this week, that the UK Treasury would sell off some of Britain’s gold holdings?

Actually, no. On this one occasion, Mr Brown’s decision was the right one. Let speculators go gambling on a shiny metal, if they want to. For most governments in rich countries, holding gold remains a largely pointless activity.

It was something of a classic of the genre as you may note that it is all blamed on speculators. Of course there are such players in the Gold market but there are also those who see it as an investment and a hedge against fiat currencies. Looking at the present price we all know who has been winning the argument. In terms of amount we were told this.

At current rates, the $3.5bn the UK received selling bullion between 1999 and 2002 would have been closer to $19bn.

These days it would be somewhere north of US $40 billion then. Which according to Mr. Beattie is around twice not very much.

The difference at current exchange rates, by the way, would be enough to cover a little over three weeks of the UK’s expected public deficit for the fiscal year 2010-2011 – not negligible, but hardly pivotal.

Comparing to now the exchange rate was mostly in the 1.60s as well so there is another loss to add in if we look in our own currency.

Central Bankers Buy again

We can look at this via Alan Beattie in 2011.

More substantively, criticism of Mr Brown’s sale also betrays a misunderstanding of why a country such as the UK has gold at all.

Now let me switch that to a collective of central bankers and jump into the TARDIS of Doctor Who so that we can move to last week and this from the European Central Bank.

Box 1 shows that central banks continued to accumulate gold at a record pace. Central banks purchased more than 1,000 tonnes of gold in 2024, which is double the average annual amount seen in the previous decade.

So after selling at the lows they are now buying at the highs! Last years purchases are of course in profit as we stand but taking the advice of the likes of Mr.Beattie and then U-Turning has led to paying much higher prices and as a collective large losses.

Global holdings of gold by central banks now stand at 36,000 tonnes, close to the all-time high of 38,000 tonnes reached in 1965 during the Bretton Woods era.

As you can see there is a Back to the Future theme running here as they head back towards the numbers of the Bretton Woods era except they have topped and tailed the market at our expense. Even a country that has relatively large reserves like Portugal sold in the 2000s, but had so much in the first place that it is still in a much better place than its peers.

As to being an inflation hedge? Well here is the ECB view and Gold prices are higher now

Adjusted for inflation, real gold prices in 2024 surpassed their previous peak seen during the 1979 oil crisis.

ECB President Lagarde

As we see so often she dissembles even in this report.

The international role of the euro remained broadly stable in 2024. The share of the euro across various indicators of international currency use has been largely unchanged, at around 19%, since Russia’s invasion of Ukraine. The euro continued to hold its position as the second most important currency globally.

Only recently we looked at her claim that the Euro could overtake the US Dollar in this regard. But she failed to point out this.

With the price of gold reaching new highs, the share of gold in global foreign reserves at market prices, at 20%, surpassed the share of the euro (16%).

Yes her claims of potential Euro supremacy turned a blind eye to the fact that the Euro was overtaken by Gold and will have weakened further since then.Also with the way she has thrown ECB research into the fire in the past they must have enjoyed adding this bit to the report.

Returning to the issue of why? Plus the difference to what Mr.Beattie previously told us the ECB suggests this.

Survey data suggest that two-thirds of central banks invested in gold for purposes of diversification, while two-fifths did so as protection against geopolitical risk.

Comment

If we look at our establishment we see that it is not just the bond market where a combination of the so-called technocrats and establishment have topped and tailed themselves.Or rather topped and tailed us as we end up paying the price in the end. They have done the same thing with Gold. At what point will they be called to account for their failings? At a lower level ordinary people lose their jobs for much more minor failings.

Switching to the Gold price itself then after such a rise it in terms of the bigger picture is no doubt due a retracement. But it could have quite a decline and the things I have written in the previous paragraph would still be true. Also yet again we see that ordinary people have often done much better than their “betters”. For example we have looked quite a few times at the mess the Turkish state has made of economic policy but it looks like their population has been much more savvy.

Turks have more gold sleeping at home than the value of ALL listed companies on Istanbul stock exchange Ayşe Teyze. ( @akcakmak)

Podcast