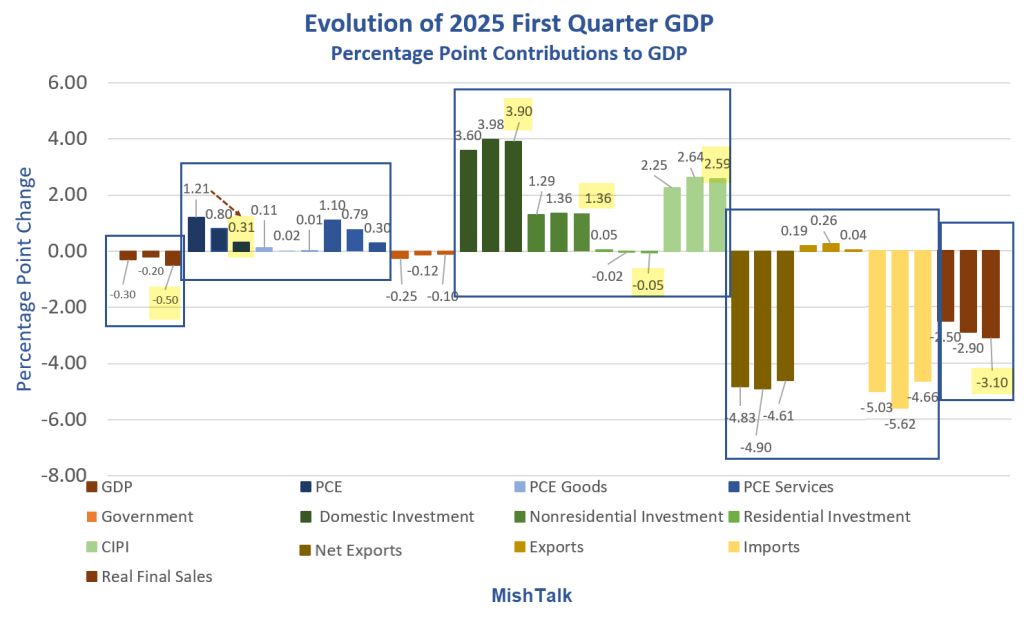

The BEA revised GDP lower by 0.3 percentage points. The details are worse.

Evolution of 2025 First Quarter GDP

Today the BEA released the Third Estimate of First-Quarter GDP.

Changes in Contributions to GDP

- GDP down 0.2 from the first revision and down 0.3 from the second revison.

- Personal Consumption Expenditures (consumer spending) went on a nose dive from 1.21 percentage points to 0.8 percentage points to 0.31 percentage points.

- Domestic investment contributed an upwardly revised 3.90 percentage points. However, 2.59 percentage points was CIPI (Change in Private Inventories) front-loading inventories. Actual sales as noted by PCE plunged.

- Net exports were revised a bit higher from the initial -4.83 percent to a final -4.61 percent.

- Real Final Sales was down 0.4 percentage points from the first report and another 0.2 percentage points from the second to -3.10 percent.

Real Final Sales is the bottom line estimate of the economy. The rest is CIPI that nets to zero over time.

You can see this by subtracting CIPI from the top-line estimate now downgraded to -0.50 percent.

Economists Missed the Boat

The Bloomberg Econoday consensus was 0.2 percent unchanged from the second report.

Is the GDPNow Nowcast for the Second Quarter Overstated?

On June 25, 2025 I asked Is the GDPNow Nowcast for the Second Quarter Overstated?

Let’s check out some of my comments.

The Bloomberg Econoday Consensus trade estimate is $-90.7 Billion in a wide range of $-93.0 billion to $-70.0 billion.

What matters is what happens vs the model expects. I highly doubt the model expects a deficit of a mere $70.0 billion. Should that happen, I believe GDP estimates would soar.

In contrast, I suspect a deficit over $90.0 billion would likely to be negative to the model.

Key reports on the 26th plus Personal Income and Outlays on the 27th will heavily influence the forecasts. GDPNow on the 27th will reflect Personal Income and Outlays.

The Bloomberg Econoday range of Personal Consumption Expenditures is -0.2 % to 0.4 % with a consensus of 0.2 percent. That seems high given a dismal retail sales report for May.

However, it not the consensus estimates that matter. It what the model expects that matters.

Given poor retail sales, I thought PCE was high. And now we see huge revisions from the first contribution estimate of 1.21 down to 0.31 and that does not factor in May .

Today the Commerce Department reported International Trade was -96.6 billion bigger than the highest Bloomberg estimate. That means more inventory front-running.

Tomorrow the BEA reports personal consumption expenditures for May. The Consensus is +0.2 percentage points. I’ll take the under.

These changes are so wild that I do not know how the GDPNow model will react to them.

Related Posts

June 16, 2025: QCEW Report Shows Overstatement of Jobs by the BLS is Increasing

The discrepancy between QCEW and the BLS jobs report is rising.

June 17, 2025: Retail Sales Down Much More than Expected, Drop 0.9 Percent

Retail sales declined 0.9 percent led by autos down 3.5 percent.

June 23, 2025: Existing-Home Sales Rise 0.8 Percent in May, Inventory Soars

Existing home sales rose but flounder at low levels. Rising inventory will eventually impact prices.

Residential construction is dismal. And if you are honest you will admit the rise in nonresidential investment is due to Biden’s spending splurge than anything Trump did.