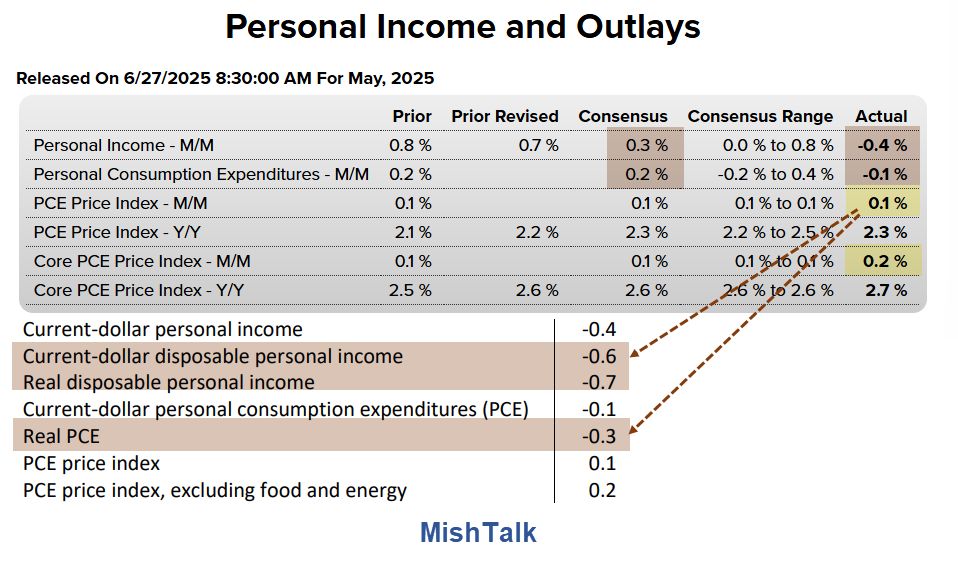

Economists missed the boat by a mile on income and expenditures.

The BEA’s Personal Income and Outlays report for May 2025 was much weaker than economist’s consensus expected. Spending was a bit higher than I expected.

To arrive at real numbers, subtract the PCE price index from income and PCE. Rounding explains differences.

I calculate the PCE Price Index M/M as 0.135 percent, a bit higher than the BEA’s rounded number. I calculate Personal Income M/M as -0.426 percent, and PCE as -0.141 percent.

Thus, the BEA rounded the price index lower, income and spending higher.

On average, rounding errors wash out. But the combination this month overstates the weak nature of the headline numbers.

Personal Income and Outlays Key Points

- Personal income decreased $109.6 billion (0.4 percent at a monthly rate) in May.

- Disposable personal income (DPI)—personal income less personal current taxes—decreased $125.0 billion (0.6 percent).

- Personal consumption expenditures (PCE) decreased $29.3 billion (0.1 percent).

- The $29.3 billion decrease in current-dollar PCE in May reflected a decrease of $49.2 billion in spending on goods was partly offset by an increase of $19.9 billion in spending for services.

- The sum of PCE, personal interest payments, and personal current transfer payments—decreased $27.6 billion in May.

- Personal saving was $1.01 trillion in May and the personal saving rate—personal saving as a percentage of disposable personal income—was 4.5 percent.

PCE Price Index Key Points

- From the preceding month, the PCE price index for May increased 0.1 percent.

- Excluding food and energy, the core PCE price index increased 0.2 percent.

Real Personal Income

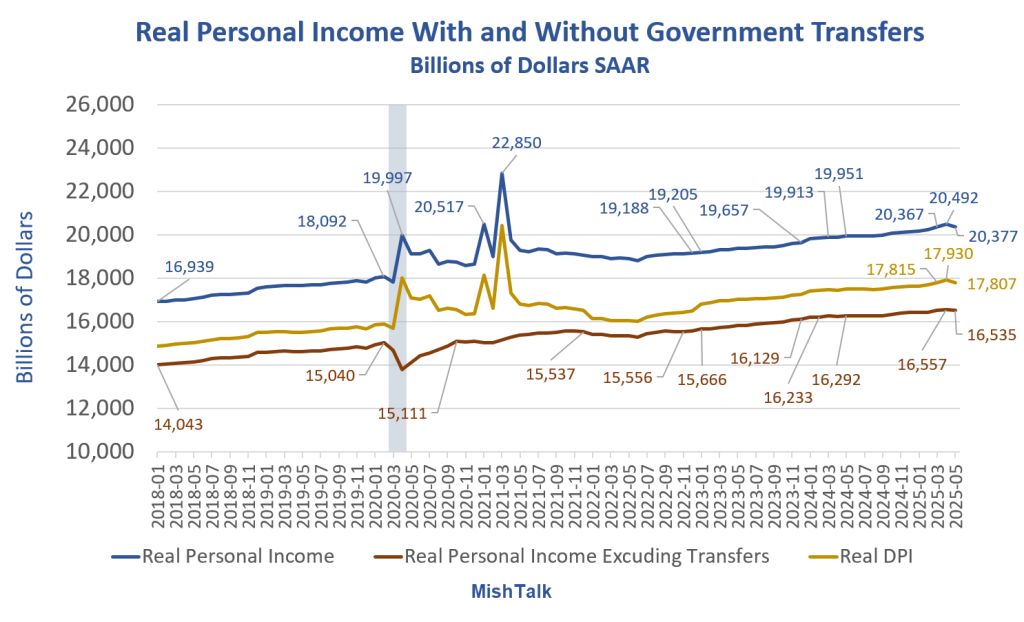

Personal Current Transfer Payments (PCTR) are government payments for which no current services were performed. PCTR included Medicare, Medicaid, SNAP (food stamps), Social Security, and subsidized housing.

I will dive further into PCTR later today, but Social Security was down 7.3 percent accounting for most of the decline in income.

Social Security payments were not down in May; they were simply distributed later in the month than usual due to the Social Security Administration (SSA)’s payment schedule. Specifically, the second Wednesday of May, which is the payment date for those with birthdays between the 1st and 10th, fell on May 14th, making it the latest possible date for the first round of payments in any month.

The NBER, the official arbiter of recessions, follows Real Personal Income Excluding Transfers.

Real PI minus PCTR was down 0.133 percent by my calculation. That’s the important number.

The three free money massive spikes in income in the above chart are what fueled inflation during and following the Covid pandemic.

Dips in Real Personal Income are very recessionary.

Related Posts

June 26, 2025: Trade Deficit Increases as Imports Decline 0.75% and Exports Decline 5.9%

Welcome to another nasty set of trade data numbers.

June 26, 2025: Unexpected Huge Negative Revisions to First-Quarter GDP and What it Means

The BEA revised GDP lower by 0.3 percentage points. The details are worse.

I will comment on GDPNow next. It did much better than I expected because its model expected the actual data better than the economists.

Trying to guess what the GDPNow model has priced in is not an easy task.