My biweekly read-around…

Clearing-out some tabs I want to write something longer about, but do not have time to do so…

&, I think, 100% correct. Addressed to the appreciative audience of Anderw Sharp. At 50:40:

<https://sharptech.fm/member/episode/gelsinger-out-at-intel-20-years-of-structural-challenges-and-strategic-blindspots-the-board-and-whats-next>:

A closer look at Intel’s fall from grace in the wake of CEO Pat Gelsinger’s sudden retirement and with the company facing a fresh round of questions about its future. Topics include: Ben’s overview of a 20-year run of paradigm shifts and strategic missteps, Gelsinger’s strengths and weaknesses, CHIPS Act funds and a looming inflection point, and the murky path forward for American made chips…

Ben’s basic point is that Intel’s troubles starting in 2021 were the result of decisions and missteps taken in 2011, and will require a timespan of the same order to correct. To hire Gelsinger as CEO, declare that you are 100% behind him, and then can him after 3 1/2 years, blaming him for his failure to have done the impossible in a short time period—that is just malpractice. I can see a case for revisiting Gelsinger’s plans at the end of 2025, after Intel 18A is well-launched and we have something of a market verdict on it. But that is fully a year away.

You can argue—and Ben does—that the board should not have hired Gelsinger 3 1/2 years ago because the task he thought he could accomplish was in fact impossible. You can argue—and I do—that Gelsinger’s plan was (probably) bad for shareholders, good for stakeholders as a whole, a wonderful thing for the country, and the best thing that could be done with Intel for the world. But in either case—or if you think Gelsinger’s plan was probably good for shareholders as well—once in, you are in. In the (perhaps apocryphal) words of Napoléon Bonaparte: “if you set out to take Vienna, take Vienna!”

…Yet investors do not mind: Alex Heath, Tim Tully, & Nathan Beniach discuss:

The most ambitious and costly gamble the tech industry has arguably ever made… artificial intelligence… the idea that one day soon big companies across all kinds of industries will be spending hundreds of billions of dollars on AI products. Today, though, that’s just… not happening…. Actual spending on AI products… is growing fast but hit only $13.8 billion in 2024 — barely covering the year’s two largest AI fundraising rounds from OpenAI and xAI…

<https://www.theverge.com/2024/12/5/24313373/ai-spending-enterprise-profits-investment-menlo-ventures-openai-anthropic-decoder-podcast>

My take is this:

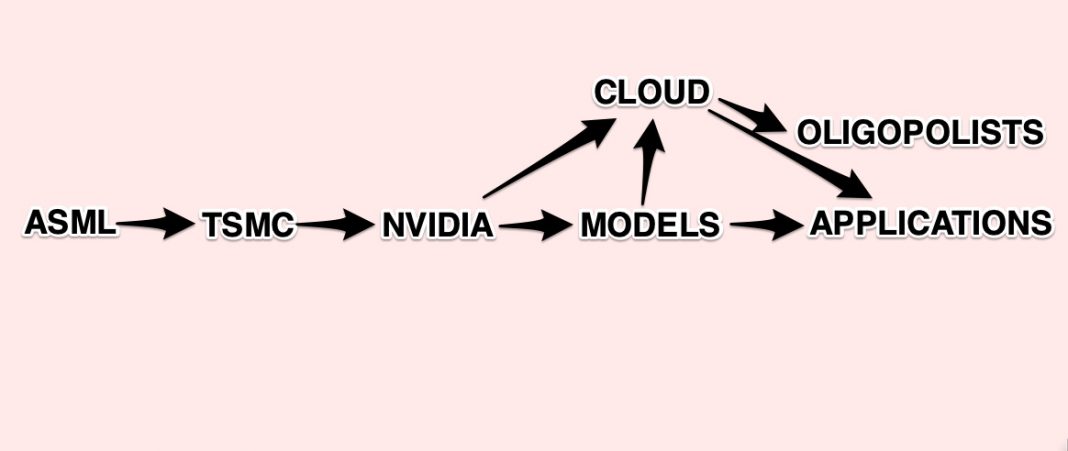

Downstream of everyone are the Applications, and beyond them the non-tech Customers—people actually trying to use MAMLMs to do things that are actually useful to real people: make things for non-tech buyers, provide services to non-tech customers, or at least write code that will be used to do this.

Half a length behind, at their hindquarters are the oligopolists—Microsoft, Facebook, Google, Apple, Amazon, Oracle—who coin money because they have massive lock-in nobody can do what they do cheaply enough to induce customers to pay substantial switching costs and still make a profit. These oligopolists, however, are terrified that “AI” will allow competitors to disrupt them in a Christensenian sense, and so they are spending like water so that their “AI” capabilities will be robust enough to head off that possibility. They do not expect to make money off of “AI”—Microsoft’s hopes of taking search market share from Google aside—but they do think they have to pay the “AI tax”, and pay through the nose, because they believe if they do not jump on this now it could rapidly become an existential threat.

Immediately upstream of the Applications and the Oligopolists are, first, the Cloud-Providers—Microsoft, Google, Amazon, Oracle—right now making money selling computation services and yet spending all that money and more expanding their capacity. Immediately upstream of the Applications and the Oligopolists are, second, the Model-Builders—OpenAI, Anthropic, and so forth—right now lighting money on fire trying to train the best model so that they can someday make money. But that is almost surely a vain hope because Facebook has opensourced LLaMA, and will keep it good enough and interoperable enough that nobody will ever make significant money selling foundation-model services to anybody. So what keeps the Model-Builders working is the gullibility of funders and the hopes of engineers that working on this now will get them in the room when AGI emerges, and they can be in its first tranche of worshippers.

Upstream of the Cloud-Providers and the Model-Builders is NVIDIA, coining huge amounts of money because Jensen Huang has convinced everyone that they dare not wait the two years it would take them to build-out a much cheaper non-NVIDIA stack—everyone except Apple, that is, which seems to be betting a bunch on the currently non-existent M4, M5, and M6 Ultra and Extreme chips. (But do note that Google has and Facebook and Amazon are building their own NVIDIA competitors).

Upstream of NVIDIA is TSMC, which made some substantial mistakes in setting its prices when it negotiated with NVIDIA, and so is simply begging at the table at which NVIDIA dines.

Upstream from TSMC is ASML, licking crumbs off the floor that fall when NVIDIA tosses scraps to TSMC. (Do, however, note that they are “crumbs” only in a very relative sense:

)

Right now the people who are getting huge amounts of value from “AI” are:

People who may get substantial value from “AI” over the next five years are:

-

Oligopolists, who may get some insurance, some protection against Christensenian disruption.

-

Customers, to the extent that “AI” actually assists them—but so far, with the possible exception of Facebook’s ad-targeting, there is still much too much of a “Clever Hans” nature in everything except for programmer-coding assistance.

Everyone else looks to me to be spending lots of money for what looks to be, at best, a low rate of return—at least until ASML and TSMC can redivide the profit pie.

In short: This is nuts! When’s the crash? But at least after the crash we will have lots of Cloud-GPU capacity to draw on and use.

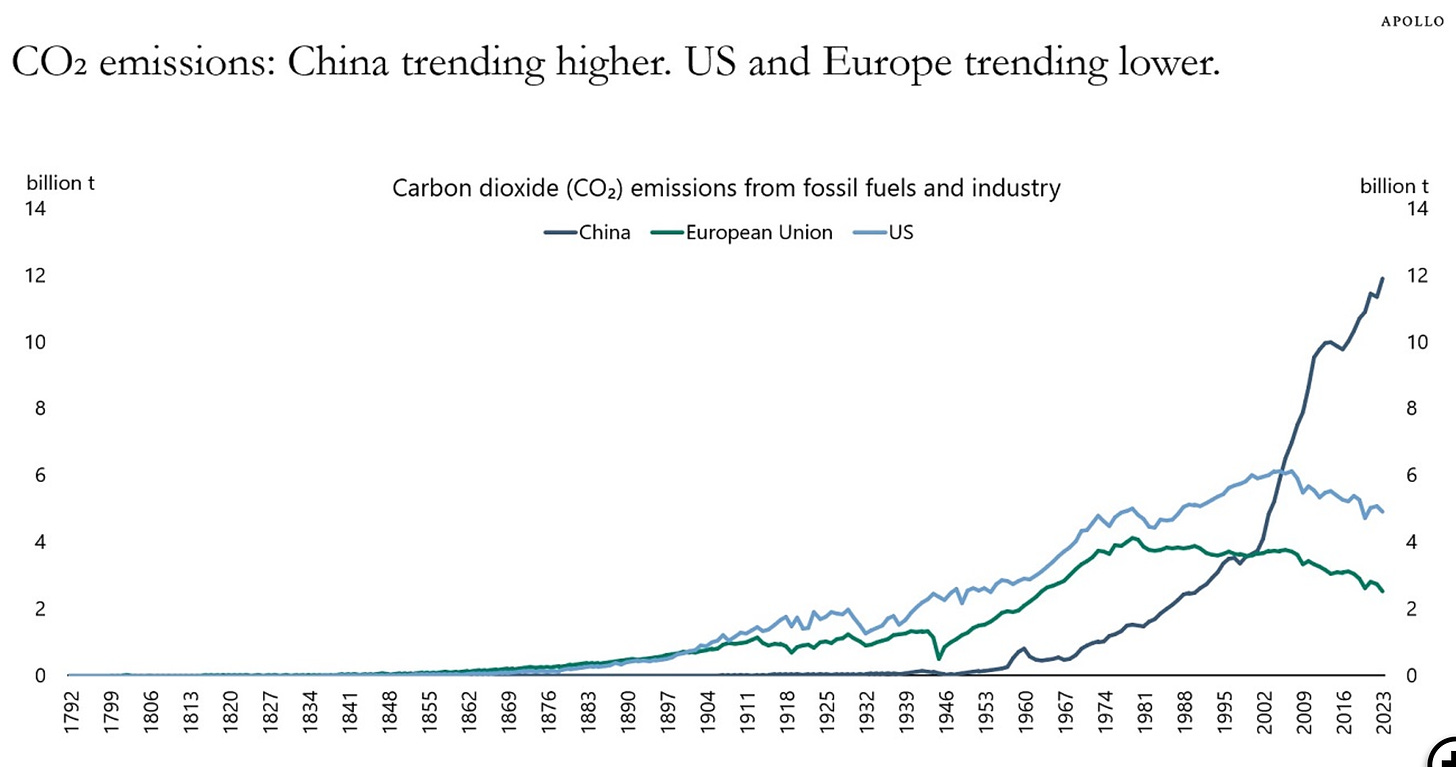

U.S. and E,U. cutting their annual CO2 emissions by 35B tons/year since their peak; China raising its by 8B ton/year since 2000.

-

Economic Development: The loss of “Third World” as a term one is supposed to use in polite society is, to my mind, a damned shame. “Tiers État” has a long and very honorable history, and that echo was useful and evocative—but, alas, only me and perhaps 5000 other people worldwide get the reference these days:

Oliver Kim: The Rhetoric of Underdevelopment: ‘A potted history of what we call poor countries…. “Underdeveloped…” was… most common… up till the 1960s…. “Developing country” took over in the optimistic 1960s…. This changed in the fat years of the 1990s… [when in] a global commodity markets boom, “emerging market” took off…. What do we call this bloc? The dominant term… was the “Third World”… of the French demographer Alfred Sauvy, in conscious reference to Abbe Sieyés’s revolutionary pamphlet “What is the Third Estate?”…. But, much like being “homeless”, the stigma of poverty soon transformed a neutral term into a pejorative…. Global South… is a 1969 invention of Carl Oglesby… fits neatly into the dependency theory of Prebisch and Singer… [and] reflects the common left-academic hope that terminology can reshape thought, that the right word can shock us back into collective action…. [But] “Global South” will likely assume its place alongside “developing” and “Third World”—as an easy put-down from the mouths of the rich… <https://www.global-developments.org/p/the-rhetoric-of-underdevelopment> -

Finance: I am not sure this is best characterized as “a bubble”. The world outside is crazy enough that “wealth in New York or Los Angeles” possesses a good deal of insurance value that wealth anywhere else does not. Of course, this makes it very hard for the U.S. to be a manufacturing powerhouse, which means that the government role in R&D needs to be massively upped, and upped in “development” area where state capacity is not obviously present:

Ruchir Sharma: The Mother of All Bubbles: ‘The US has never been so overhyped…. The US accounts for nearly 70 per cent of the leading global stock index, up from 30 per cent in the 1980s. And the dollar, by some measures, trades at a higher value than at any time since the developed world abandoned fixed exchange rates 50 years ago…. America’s share of global stock markets is far greater than its 27 per cent share of the global economy…. It’s as if America is the only nation worth investing in…. As with all bubbles, it is hard to know when this one will deflate, or what will trigger its decline… <https://www.ft.com/content/49cca8d7-7b6e-47e3-a50c-9557d7c85fc0> -

Tech & Economics: The one piece of good news from Intel over the past month:

Zaheer Kachwala: Intel’s interim co-CEO Zinsner says new chief executive will have foundry experience: ‘Interim co-CEO David Zinsner…. “I’m not in the process, but I’m guessing that the CEO will have… both some capability around foundry as well as on the product side…”. The company also requires a significant cultural change to become a successful foundry player as well as in the semiconductor business, Intel’s head of foundry manufacturing and supply chain Naga Chandrasekaran said…. Chandrasekaran said Intel’s progress on the 18A advanced node manufacturing process was going as expected and has met several milestones despite facing difficulties and technical problems. “There’s nothing fundamentally challenging on this node now. It is about going through the remaining yield challenges, defect density challenges,” he said. Intel plans to provide samples of chips made with the new node to customers in the first half of next year, and start to ramp the production at its Oregon plant in the second half, Chandrasekaran added… <https://www.reuters.com/technology/intels-interim-co-ceo-zinsner-says-new-chief-executive-will-have-foundry-2024-12-04/> -

Tech & Economics: The Verge has a new business model! It is called “a website”! And it seems to be working:

Nilay Patel: Here we go: The Verge now has a subscription: ‘A lot of our site will remain free, but you can now pay to get fewer ads and unlimited access to all of our work…. We decided to make our own site as valuable to you… as we could…. Quick Posts and the Storystream news feed…. This worked: we’ve maintained a massive loyal audience despite industry-wide declines in Google referrals and big social platforms downranking links…. 55,000 of you have come to the site every single day this year. A lot of you really like The Verge, and we’re eternally grateful for that — we intend to keep making this thing together for a long, long time…<https://www.theverge.com/2024/12/3/24306571/verge-subscription-launch-fewer-ads-unlimited-access-full-text-rss> -

Tech & Economics: The very short-course version:

Sean Hollister: What happened to Intel?: ‘Intel has ejected its CEO. There are many possible reasons why…. Over a decade ago, Intel spent billions investing in Dutch multinational ASML, which is today the most important company in chips. It’s the only firm in the world that manufactures machines capable of pulverizing a ball of tin, using high-power lasers, such that it emits an extremely tight wavelength of ultraviolet light to efficiently carve circuits into silicon wafers, a process known as EUV. Intel initially believed in the tech, even carving out a $4.1 billion stake in the company, then decided not to order the pricey machines. But Taiwan’s TSMC did — and went on to become the undisputed leader in silicon manufacturing, producing an estimated 90-plus percent of the world’s “leading-edge logic chips.” Samsung ordered machines, too. Gelsinger was not shy about calling Intel’s choice “a fundamental mistake” in our 2022 interview. “We were betting against it. How stupid could we be?”… Moorhead and Creative Strategies analyst Ben Bajarin both believe Gelsinger’s departure was so sudden, it can’t simply have been the straw that broke the camel’s back. “There must have been a decision the board made that he was not going to stick around for,” Moorhead tells me…<https://www.theverge.com/2024/12/3/24311594/intel-under-pat-gelsinger> -

Neofascism: Elon Musk continues to try to convince the Delaware Chancery that laws protect him, but do not bind him. I suppose his next move is to buy an opinion from the Texas Supreme Court, and then the U.S. Supreme Court, to remove the case from Delaware Chancery jurisdiction:

Kathaleen McCormick: Opinion Awarding Attorney’s Fees And Denying Motion To Revise The Post-Trial Opinion: ‘The motion to revise is denied. The large and talented group of defense firms got creative… but… there are at least four fatal flaws…. The defendants have no procedural ground… based on evidence they created after trial…. Common-law ratification is an affirmative defense that must be timely raised…. What the defendants call “common law ratification” has no basis in the common law…. [And] even if a stockholder vote could have a ratifying effect, it could not do so here due to multiple, material misstatements in the proxy statement…. The fee petition is granted in part. The plaintiff’s attorneys asked for $5.6 billion in freely tradeable Tesla shares. In a case about excessive compensation, that was a bold ask… <https://courts.delaware.gov/Opinions/Download.aspx?id=372420> -

Neofascism: By contrast, here in Berkeley the only thing we neg people for in public is for wearing Dodgers caps:

Lynn Dean: ‘On a road trip in mostly red states. People are not ok out here. 1) The amount of complete dumbfuckery on display at every turn is DISTURBING. Gas station cashier lost her shit yesterday morning and started screaming at people’s inability to manage pulling in and out of the pumps without blocking each other, and I couldn’t blame her. 2) Someone has been vomiting in the stall next to me at almost every public restroom for 2 days. Opiods? Alcohol? ¯\_(ツ)_/¯. Performative angry displays of “god, guns, and country” everywhere – I have been confronted about my blue state plates A LOT. 4) Disturbing numbers of closed storefronts, graffiti, or stores with sparse, old, dusty, or spoiled goods in every town. Except Walmart, which is booming. 5) Sharps containers in all the public bathrooms – I assume for insulin syringes? People are eager to tell me that my blue state is a Zombie apocalypse with poop in the streets, but the zombies are HERE. This feels like it is leading somewhere very bad… <https://www.threads.net/@idle_lynn/post/DDF6B-qyuFt> -

Public Reason: This puts something I have been groping towards into words much better than I ever have:

Jeff Jarvis: ‘How I despise the “culture war” framing. Were anti-miscegenation laws “culture”? Was slavery? Was burning witches? Thus media moral-wash bigotry & GOP-manufactured moral panic. “Supreme Court Returns to a Culture War Battleground: Transgender Rights” <nytimes.com/2024…>. What is a better framing? Civil rights. Human rights. Moral panic. Bigotry. And while we’re at it, banning books is not “culture war.” It is censorship. Journalists: Call these acts what they are, not in the terms set by the instigators… <https://www.threads.net/@jeffjarvis/post/DDHg-JbJOUF?>

-

Reading: The fact is that every decade I find a new reason to reread this, and it is—nearly—as dead-on as when I first read it in the 1970s, but each decade it is dead-on in a slightly different way:

Graham Greene: The Quiet American: ‘“York [Harding]”, Pyle said, “wrote that what the East needed was a Third Force”. Perhaps I should have seen that fanatic gleam, the quick response to a phrase, the magic sound of figures: Fifth Column, Third Force, Seventh Day. I might have saved all of us a lot of trouble, even Pyle, if I had realized the direction of that indefatigable young brain… <https://archive.org/details/in.ernet.dli.2015.462196>

If reading this gets you Value Above Replacement, then become a free subscriber to this newsletter. And forward it! And if your VAR from this newsletter is in the three digits or more each year, please become a paid subscriber! I am trying to make you readers—and myself—smarter. Please tell me if I succeed, or how I fail…