A recent article in The Economist discussed what they assume is the president-elect’s view of interest rates:

A more hawkish Fed may, in turn, invite the wrath of Mr Trump, who has insisted that, as president, he should have a say over interest rates. He will surely want to see steeper rate cuts now that he is in charge.

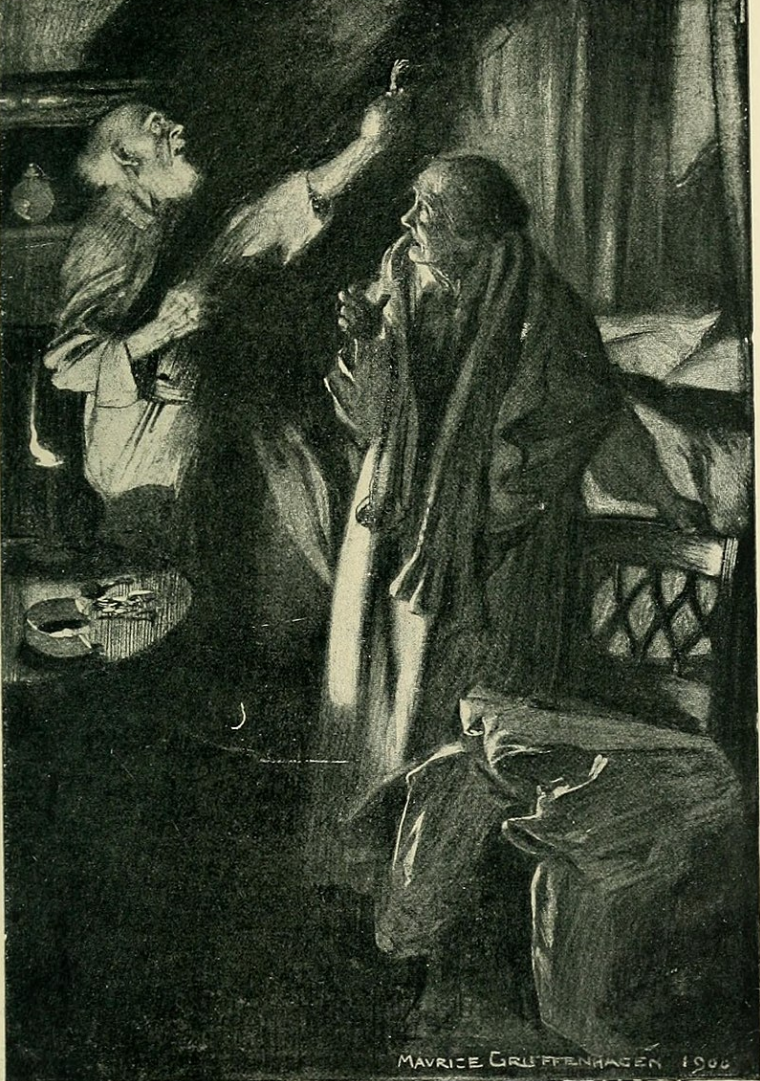

This reminds me of a story entitled The Monkey’s Paw, where the protagonist is granted three wishes, which don’t turn out as well as intended. Let’s consider some possible outcomes, and then evaluate the sort of interest rate path that Donald Trump should prefer.

1. In most occasions, steep interest rate cuts are associated with recessions. Recent examples occurred in 2020, 2008, and 2001. Recessions are unpopular.

2. One might argue that The Economist meant that Trump prefers a steep decline in interest rates combined with a strong economy. And the economy currently does appear quite strong, with the Atlanta Fed forecasting 3.3% growth in Q4. But there is a substantial risk that a steep cut under that scenario could trigger high inflation. At the moment, the fed funds futures market is predicting some rate cuts over the next few months, but at a less steep rate of decline than we’ve seen in recent months. At the same time, market inflation expectations are slightly above target. If the Fed were to adopt even “steeper rate cuts” than seen in the recent past, despite the robust NGDP growth, there would be a very real risk of inflation re-accelerating. Inflation is unpopular.

3. Perhaps the Fed rate target is still far above equilibrium. (But then why is growth so strong?) Perhaps it will be possible to cut rates and keep the expansion going, as we saw in 2019 and 1998. But we’ve already seen a 75-basis point cut. It would be almost unprecedented to see an even steeper cut from this point forward, without either re-igniting inflation or being a response to recession.

To be clear, I am not saying that we are likely to get a recession or high inflation. But that’s because I do not expect to see even steeper rate cuts. I expect the pace of rate cuts will actually slow in 2025. And I believe this would be the best possible result. Indeed I’ll go even further. If these three scenarios were fully explained to Trump, I doubt he’d be rooting for “steeper rate cuts”, especially if he had recently read The Monkey’s Paw.

Or Goldilocks and the Three Bears.

This is an illustration from The Monkey’s Paw: